Corporate Office

PO Box 6090, La Quinta CA 92248.

Unexpected events can happen, and Cashback Loans is here for you when they do. We offer paycheck advance loans for immediate cash based on your upcoming paycheck. We make it easy to apply — all you have to do is fill out a form online, and we will deposit the loan into your bank account within 24 hours.

Cash advance loans, also called payday loans, are short-term loans that provide immediate access to funds to cover financial emergencies. These funds can be used for car repairs, house maintenance costs, emergency expenses, or any other financial situation. Ultimately, they are used to bridge the gap between paychecks to cover urgent expenses or emergencies.

Whether you have unexpected medical, house, or car expenses, we have you covered. Our check advance loan application process is fast and simple, so you can get the additional funds you need in no time.

Some specific benefits of California cash checking loans include:

You can typically obtain a cash advance within 24 hours with our five-minute online loan application. Our rapid approval process means that you can have cash in your account quickly from a state-certified direct lender.

If you are looking for a cash advance loan to cater to your financial emergencies, our team at Cashback Loans is ready to help. Submit your online application now, and let us get you that instant funding you need.

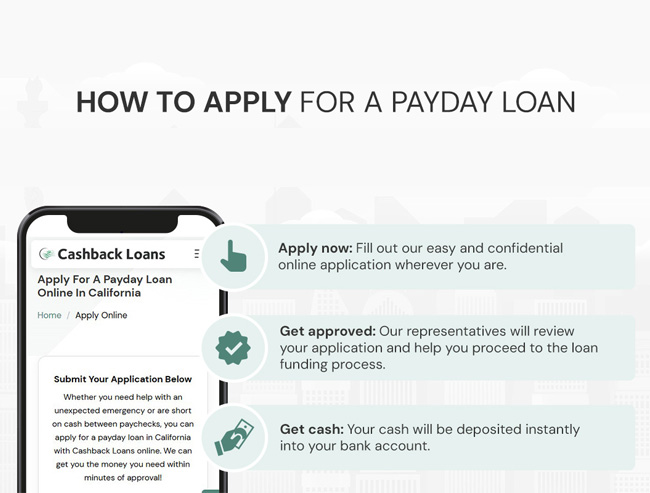

Here's a quick look at our application process:

California cash advances are given based on your income and ability to pay back the loan with your next paycheck. To apply for a payday advance, you will need the following items:

Cashback Loans has been a state-certified direct lender for 20+ years, providing check advances, 24-hour payday loans, emergency payday loans and more. When you’re approved for a loan through Cashback Loans, you borrow directly from us! This means there are no middlemen, and your information isn’t sold or transferred to other lenders.

Our professional representatives are ready to assist you in person or over the phone. Apply today or contact us for more information.

PO Box 6090, La Quinta CA 92248.