What Is a Payday Loan

Payday loans are a convenient way to access extra funds when you need them most. They are short-term loans designed to cover unexpected expenses that you can’t postpone until your next paycheck. When you apply for a payday loan, you’ll be asked to provide your next paycheck date, and you can expect to pay the loan back in full on that date.

This quick turnaround can help you deal with unexpected emergencies or bills. That said, payday loans also come with higher interest rates to compensate for their speed and the smaller number of requirements compared to traditional loans. As such, it's important to take out these loans carefully with a lender you can trust.

Payday loan lenders like Cashback Loans make borrowing money much easier than what you might be used to.

Getting your money starts with an application, either in-store or online. From there, our team will review your submission and transfer the funds, often all within the same day!

We’ve optimized the process as much as possible for your convenience. We strive to have money in your bank account on the same day when possible!

Make Today My Payday!How Do Payday Loans Work?

Payday loans work slightly differently depending on the lender and the state you're in. In California, for instance, you can only borrow up to $300 through payday loans. In Georgia, you can't take out payday loans at all. However, some steps and requirements are universal in states that allow payday loans.

You can apply online or in person. Cashback Loans has seven physical locations in Southern California you can visit, for instance. The loan process typically starts with an application, so let's look at some things you'll need to fill out this application.

Eligibility Criteria

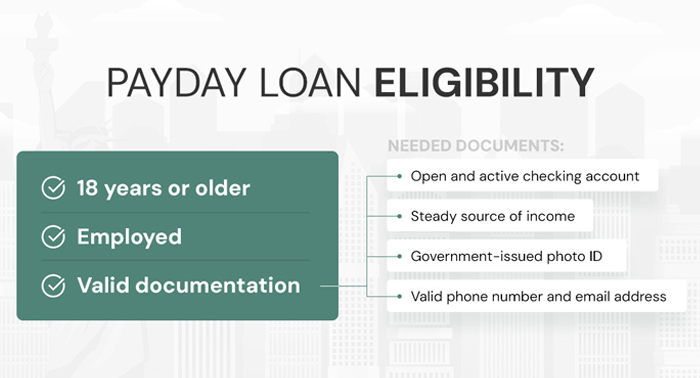

There are some basic payday loan requirements you'll need to have, including:

- Being 18 years or older.

- Being employed.

- Having valid documentation.

If you meet these criteria, you are eligible for a payday loan with Cashback Loans.

Documentation Needed

To complete your application and prove your eligibility, you will need:

- An open and active checking account.

- A steady source of income.

- A government-issued photo identification.

- A valid phone number.

- A valid email address.

If you're setting up the loan in person, make sure you come prepared to provide your bank account number, proof of income and your ID. If you visit without these items, you may not be able to take out the loan when you need it. If you don't want to provide your bank account information, you will need to pay with a check at the end of the loan period.

This documentation allows the lender to verify your identity and contact you for repayment. Some payday lenders may also ask for your Social Security number, but we at Cashback Loans don't.

Approval and Funding

Once you fill out and submit your application, the payday loan company will evaluate it to determine if you're eligible. They want to be thorough while still getting back to you as quickly as possible. The main thing they'll need to do first is verify the information you've provided.

If you're approved, you will receive the loan through your bank account or at the lender's physical location. At Cashback Loans, our team can approve your loan and get you your funds on the same day. If your bank doesn't accept instant funding, the loan will be in your account the next day.

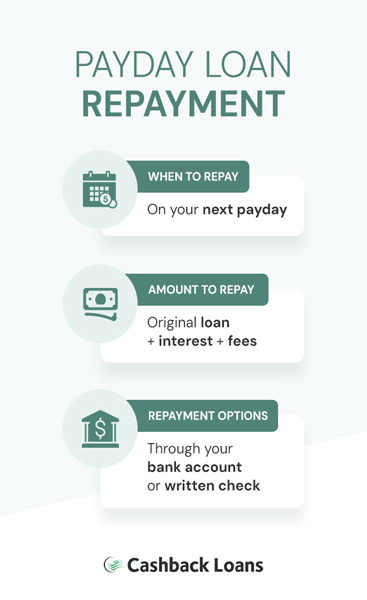

Repayment Process

When you receive your next paycheck — whether in a month or two weeks — you will need to repay the loan plus interest and any fees through your bank account or a written check.

The Size of Payday Loans

How much you can borrow will vary based on the lender and your state's regulations. Arizona, Arkansas and several other states have made payday loans illegal, but in most states, it's a regulated practice. Lenders must follow those regulations to obtain and keep their licenses.

In California, payday loans are capped at $300 a loan. As such, Cashback Loans only offers payday loans between $100 and $300.

Other states' limitations may differ, and you may be able to take out larger loans based on your income level. Before taking out anything, however, make sure you understand your state's regulations and the cost of taking out the loan.

The Cost of Payday Loans

Payday loan costs will vary based on your needs and the lender. Many payday loan companies charge a flat fee for every $100 loaned, and these fees tend to range from $15 to $30. In California, the standard fee is 15% of the check amount. So, if you write a check for $300, you will receive $255 ack and the fee is $45, or 15% of $300

These fees are often used instead of a traditional interest payment, but they aren't the only fees you can be charged. If you default on the loan, you may be charged a $15 returned check fee. California does not allow renewal or rollover fees, so this is the only additional fee you will be charged on that loan.

At Cashback Loans, APR changes based on how long the money is borrowed. A loan with a two-week deadline would come with an APR of 460%. A loan with a one-month deadline would come with an APR of 214.83%. The fee is the same either way — it's just the length of time that changes.

What Credit Checks Do Payday Lenders Do?

Typically, when you take out a loan, the lender performs a credit check to evaluate your creditworthiness. There are two types — soft checks and hard checks.

Soft checks can occur when you check your own credit score or when you apply for a new job or apartment. They give you and others an easy, harmless way to evaluate your credit history.

Hard checks, on the other hand, only occur when money is at stake. If you apply for a loan or buy a house or car, the lender or seller will likely perform a hard credit check, allowing them to see your credit reports and if any other hard checks have been performed within the last two years. These checks bump your credit score down slightly, but it will bounce back over time.

Many payday lenders, including Cashback Loans, do not perform soft or hard credit checks. As such, you typically don't need to worry about your credit score dropping when you apply for a payday loan. However, if you are unable to pay off the loan, that debt may be reported to one of the national credit reporting agencies. This will likely affect your credit score.

Disclaimer

General Information Only – Not Legal, Financial, or Professional Advice

The information contained in this article is provided for general informational and educational purposes only and is not intended to constitute legal, financial, accounting, tax, investment, or other professional advice. The content is based on the author’s research and opinions as of March 11, 2025, and reflects conditions and data available at that time. Readers are strongly encouraged to consult with a qualified professional (e.g., attorney, financial advisor, accountant, or business consultant) licensed in their jurisdiction before making any decisions or taking any actions based on the information presented herein.

No Liability or Warranty

The author, [who written by], and any associated entities (including Cashbak, LLC) make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information, products, services, or related graphics contained in this article for any purpose. Any reliance you place on such information is strictly at your own risk. The author expressly disclaims all liability for any direct, indirect, incidental, consequential, special, exemplary, or punitive damages, including but not limited to loss of profits, data, or other intangible losses, arising out of or in connection with the use of or inability to use the information provided.

Not a Substitute for Professional Judgment

This article does not replace the need for professional judgment or individualized advice tailored to your specific circumstances, business, or legal obligations. Laws and regulations vary by state and change over time, and the information may not reflect the most current legal or financial standards in California or any other jurisdiction. Readers in California are particularly advised to comply with the California Business and Professions Code and consumer protection laws, including but not limited to the California Consumers Legal Remedies Act (Cal. Civ. Code § 1750 et seq.), which may impose additional disclosure or liability requirements.

No Endorsement or Guarantee of Results

The mention of any products, services, companies, or strategies in this article does not constitute an endorsement, recommendation, or guarantee of success. Results mentioned or implied (e.g., financial performance, business growth) are not typical and depend on numerous factors beyond the author’s control. Past performance is not indicative of future results.

Limitation of Liability

To the fullest extent permitted by applicable law, the author shall not be liable for any claims, lawsuits, damages, or losses, including those arising under tort, contract, or strict liability theories, resulting from the use or misuse of this article’s content. This disclaimer applies in all U.S. states and territories, subject to local laws that may impose mandatory liability (e.g., California’s Unfair Competition Law, Bus. & Prof. Code § 17200 et seq.).

Contact for Further Information

For personalized advice or clarification, contact a licensed professional in your area. The author is not responsible for providing ongoing support.